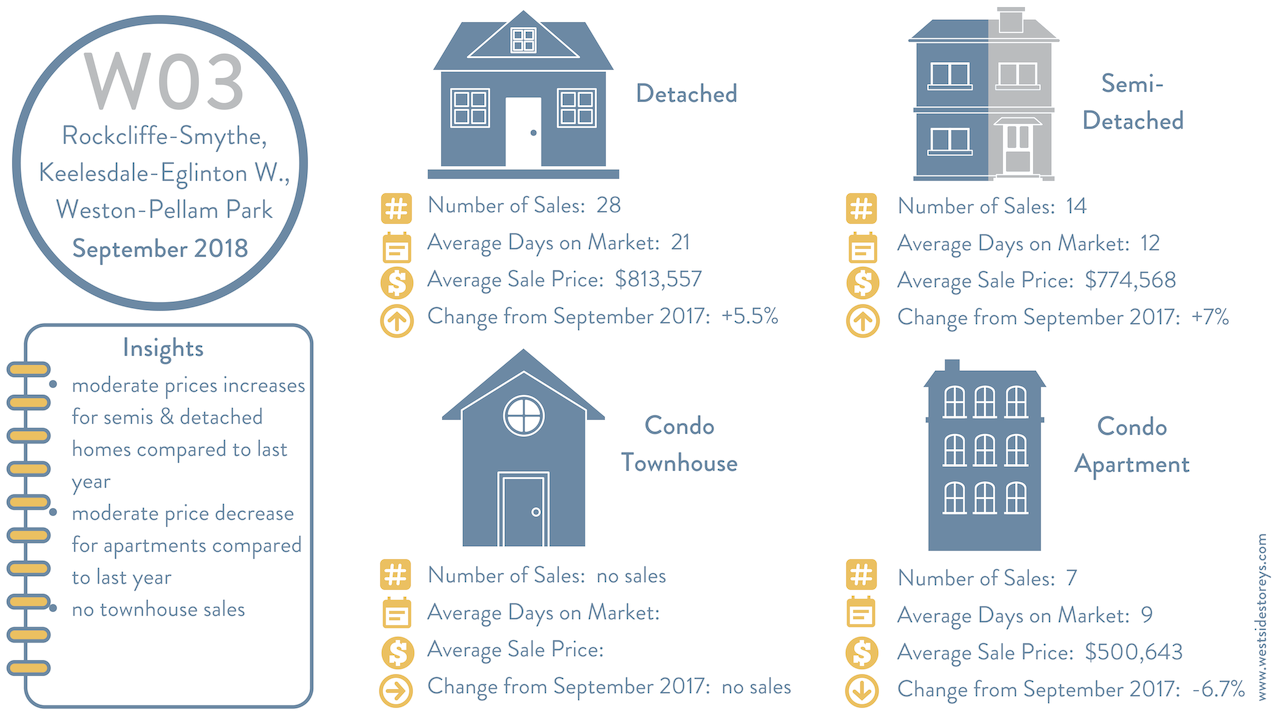

The September numbers are in and here is a snapshot of what happened in the west end Toronto real estate market last month. If you would like to compare these numbers to August, you can find them here!

Real Estate Investment 101 - Part I

You’ve maxed out your retirement fund & your children's RESP, your mortgage payments are manageable and you have some money burning a hole in your pocket. Real estate is hot and interest rates are low so purchasing an investment property seems like a no-brainer, but is it the right no-brainer for you??

I purchased an investment property in Roncesvalles with a friend of mine in 2009, and I have to say it has been a great investment and a good decision, but not without its drawbacks, so best to educate yourself and be prepared before you take the big leap…..

Get Your Finances In Order

The banks have different financing requirements for a personal residence than for an investment property. A larger down payment is required and the qualifications are more stringent, so make sure to pay a visit to your bank or mortgage broker first to ensure that you qualify.

Pick The Right Agent

Do some homework in this regard and make sure you choose an agent who knows the area where you want to buy, understands the principles of investment properties (cap rates, tax implications, income/expense reports…..more on this later) and has a good grasp on the the local rental market and the rules and regulations set out by the Residential Tenancies Act.

Risk comes from not knowing what you are doing

Warren Buffet

Do You Want To Go It Alone?

I invested with a very good friend of mine and it has worked out well, because we are both on the same page, we split the responsibilities and when things arise with the house, we pick up the slack for each other, depending on what is going on in our lives. If you can find someone to invest with, I think it’s great, you only have to come up with half the capital and you can split the workload. It doesn’t come without its pitfalls however, you have to make sure that they are someone you trust implicitly and that you both have the same long term goals & vision. If you do decide to invest with a friend or family member, have frank conversations about expectations and make sure you see a lawyer to legally document your agreement. Also, be sure to have this agreement documented in your will as well.

Location, Location, Location

How do you decide where to invest? With the rental market being what it is, it won’t be hard to find tenants pretty much anywhere in Toronto, so the best advice I can give would be to stick to what you know. In other words, buy in an area that you are familiar with or an area close to where you live. My investment property is around the corner from my house. I would like to take credit for that savvy decision, however it was really just a bit of a fluke, but I can’t tell you how convenient it is to be 2 minutes away when your tenants are calling with a problem or emergency!

What Kind of Investment Property?

Multi-unit? Single family? Condo? The type of property you decide to purchase really depends on how much you are willing to take on. The more units, the better the investment; the more tenants, the more maintenance and problems to contend with.

The Tenants

Yes, you have to deal with tenants. This is where it can get a little tricky. Personally, I have had good luck with tenants and all our current tenants are a dream, but everyone has heard the horror stories, and the Residential Tenancies Act definitely protects the rights of the tenant over the landlord, so do your homework, follow up on your reference and credit checks and keep your fingers crossed!

....and The Maintenance

You know the old adage whatever can go wrong, will go wrong, this could not be more true than with an income property. Nobody likes a slumlord so staying on top of maintenance and repairs is imperative. If you are handy all the better, but if not, you will need to have a roster of reliable trades people at your disposal.

All that said, if you are up for it, an income property is a wonderful investment and when done properly can provide a lucrative nest egg for your retirement or future housing for yourself or your family members.

This is the first in a series of blogs on real estate investing. The next one will tackle how to read the financials so you are able to pick out the good investments from the bad ones....so stay tuned!

If you have any specific questions about real estate investing, don't hesitate to get in touch, we would be happy to answer any questions!