In a city like Toronto, where real estate is a city-wide obsession and avid spectator sport, the question on everyone’s mind (and the one we get asked at least once a day!) is ‘what is going on in the Toronto real estate market?’

Given all the speculation, we thought we would take a moment to address what is going on, specifically in the west Toronto real estate market, and based on our 20+ years of experience, where we think it is going.

First things first, we’re not saying don’t listen to the media, but the media LOVES to talk about real estate, and generally, they are in one of two camps - the market is crazy and the bubble is about to burst OR the bubble has burst and the sky is falling. Neither of which has proven to be true in the last couple of decades. However, there is no denying that the market was crazy and (in our opinion) unsustainable at the beginning of this year, and that a perfect storm of influences (supply chain issues, the pandemic, the war in Ukraine, inflation, and the resulting interest rate hikes) has created a ‘pause’ in the market that we haven’t seen since the Great Recession in 2009. But even in 2009, the pause in the Toronto real estate market only lasted about 8 months and we think that this market will probably follow suit.

We don’t have a crystal ball, but these are the reasons that we think the market will start to rebound in the next 4-6 months:

sellers can only hold off for so long

there is a multitude of reasons why people need to sell their homes including death, divorce, job loss, job transfer, expanding family, etc., and while some of these reasons can be put off for the short term, at some point despite market conditions, the house will have to go on the market. At the moment, everyone who can hold off selling their homes in order to see where the market is going is doing so, but that can’t last forever.

the city is continuing to grow

we live in a large growing city with a finite number of properties. Aside from vertical growth, there is nowhere else to build in this city (hello, laneway housing!), so with the population continuing to expand, there is increasing demand for existing properties. Toronto’s population is expected to grow by $1 million people in the next 25 years and with limited inventory, the demand and price of homes will continue to rise

in some cases the reduction in price will compensate for the increase in interest rates

this is not the case in all situations, but for the savvy buyer (with an equally savvy realtor) who can spot a good opportunity, the reduction in price since the peak in February of this year could compensate for the increase in interest rates.

buyers with pre-approvals will need to buy in the next few months to take advantage of their locked-in rate

most of the buyers at the moment are investors with lots of cash on hand, first-time buyers who don’t have anything to sell, and upgraders who will save more money on the property they buy than they will lose on the property they sell. Many of these first-time buyers will have an existing 90-120 day pre-approval (and rate guarantee) and will want to buy before rates go up again and their approval expires. The more buyers that enter the market, the more demand and the higher the prices, which will ultimately motivate sellers to sell.

What does this all mean?

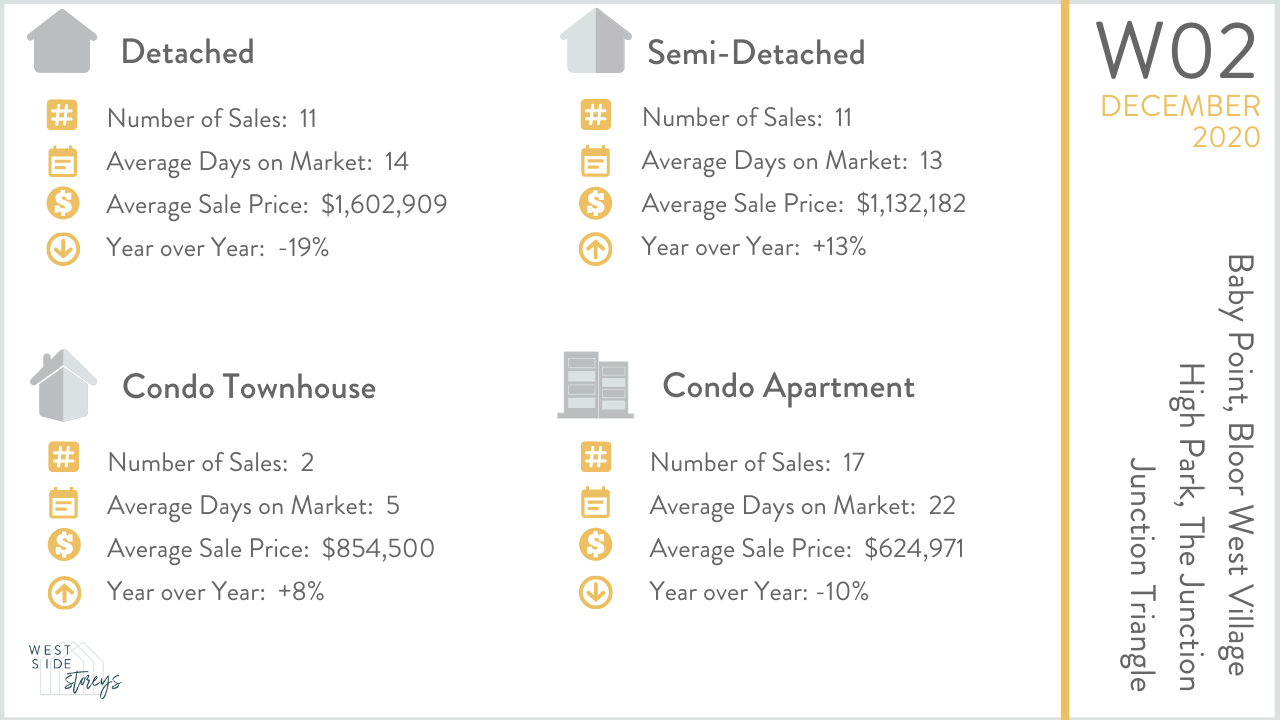

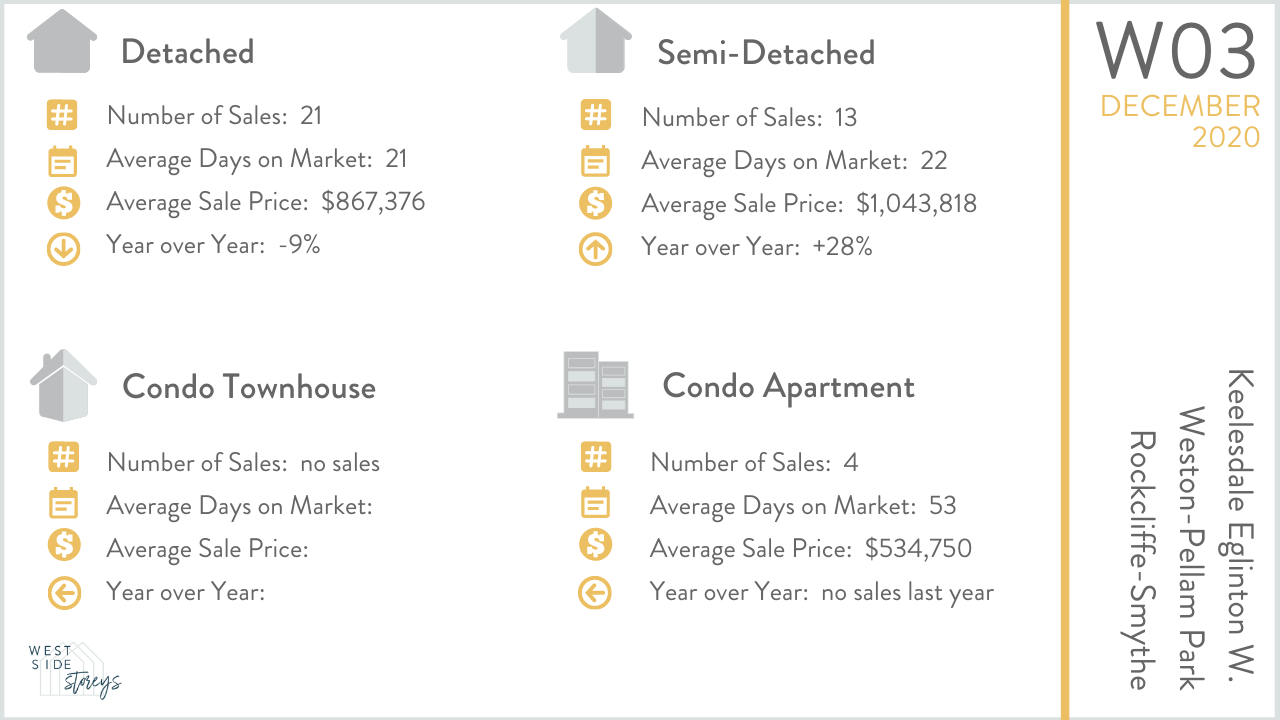

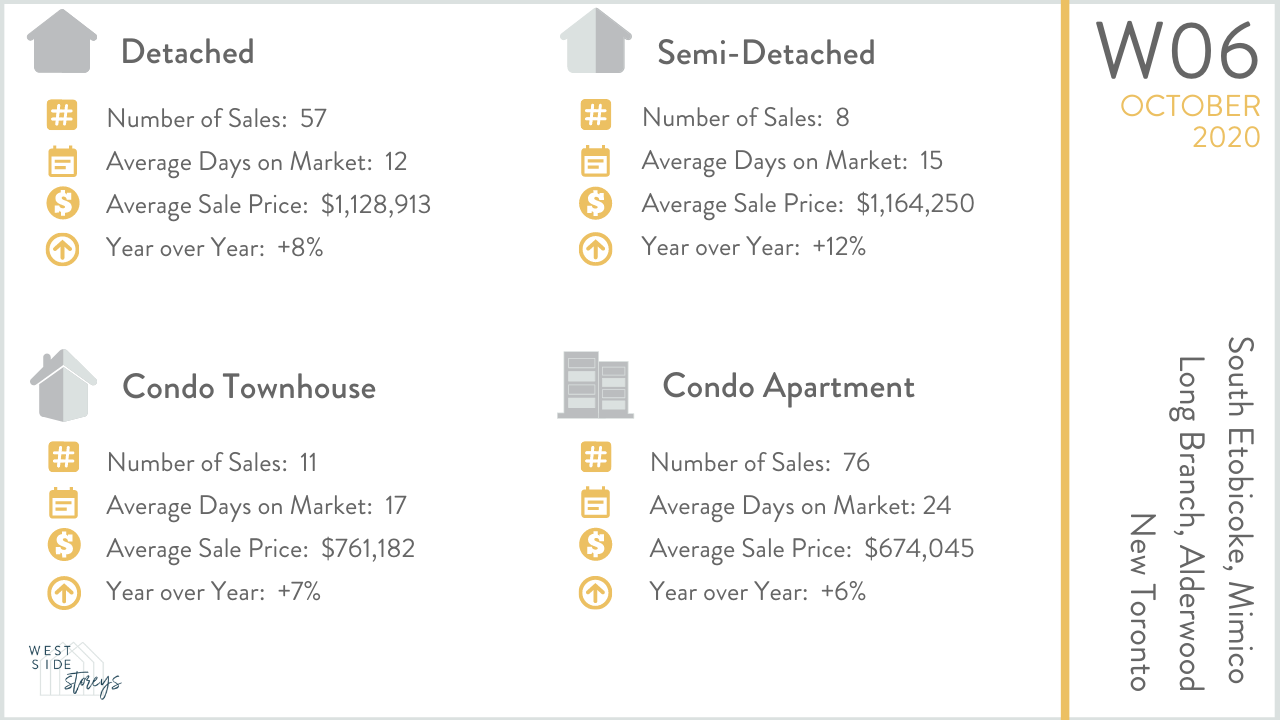

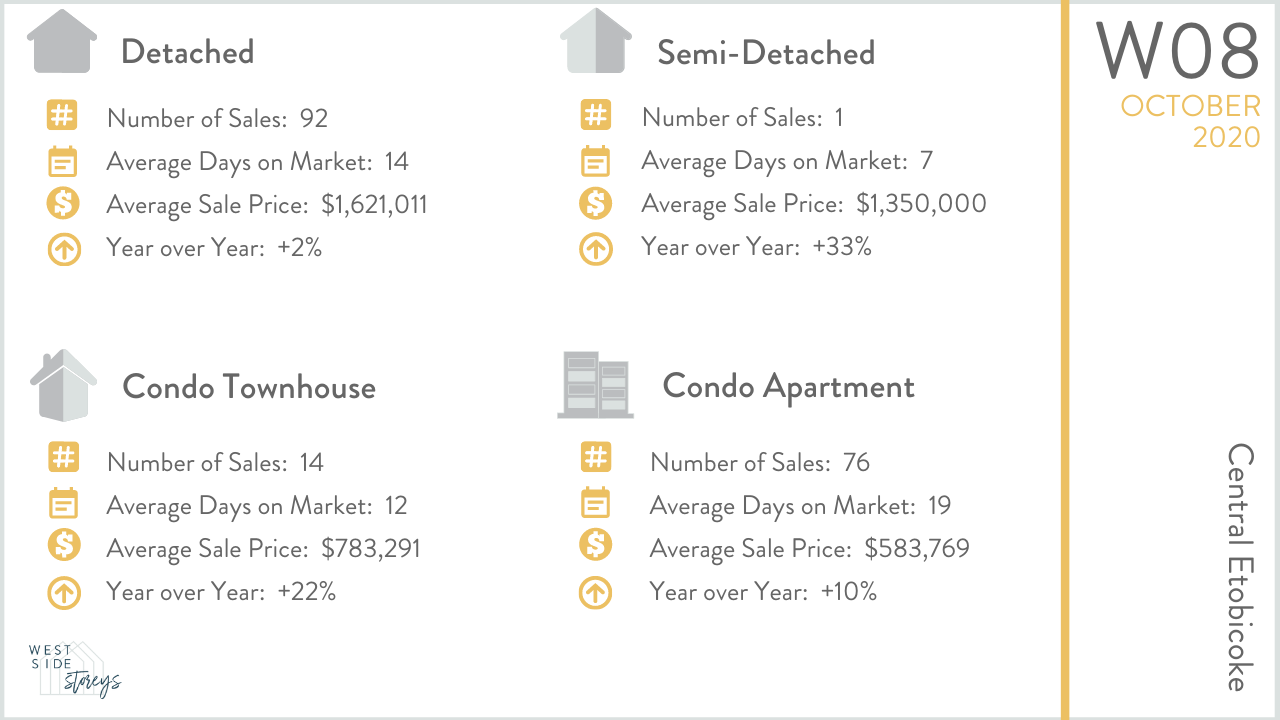

The average price in October was almost $1.1M, which has remained stable over the last few months, while the number of sales compared to October 2021, was down almost 50%. The average price was down 18% compared to the peak in February so we have definitely shifted from a seller’s market (buyers > sellers) to a balanced market (buyers=sellers), meaning homes are not selling as fast and we are seeing lower prices and less competition.

So is it a good time to buy west Toronto real estate?

If you have a pre-approval (which we highly recommend) AND you can find something that fits your parameters, then it is definitely a good time to buy. Also, if you are upgrading from a condo to a semi or detached home, you will likely benefit as well because you will save more money on your purchase than you will lose on your sale. Due to a lack of inventory, the challenge is finding a property that fits your criteria, but if you can open your mind to properties that have been sitting around a while and may have gone overlooked or are in locations that you may not have considered previously, then we suggest striking while the iron is hot, because interest rates are predicted to stay at this level for at least the next year and the market will likely bounce back before then.

What does this mean for sellers?

Sellers shouldn’t be afraid to sell in this market, homes that are well located, show well and are priced properly are selling (sometimes even in competition). In this market, pricing is crucial and since every neighbourhood is its own micro-market, make sure you have an agent who is experienced in and knowledgeable about your particular neighbourhood so they can properly advise you on where to price your home for maximum return. Also, if you are purchasing a new property that is dependent on the price you get for your current home, for the first time in a long time we highly recommend selling before you buy.

If you would like more insight into this market, or if you would like to have a conversation about how we approach real estate differently; developing a customized plan to find you your perfect home or sell your existing home in a shifting market; please don’t hesitate to reach out. We are always available for your questions!